The Best Investments for Passive Income in 2024 – Part 1

With 2023 done and dusted, it’s time we turn our attention to navigating the financial waters of 2024, and for may investors there is one big question on their mind……

With 2023 done and dusted, it’s time we turn our attention to navigating the financial waters of 2024, and for may investors there is one big question on their mind……

The Government is tinkering…. again. In the ever-evolving landscape of taxation, understanding the implications of government policies on your financial well-being is crucial. One such recent development is the Stage…

Every year around this time the world’s largest investment banks (experts, one might reasonably assume) compile their forecasts of where financial markets will end up at the end of the…

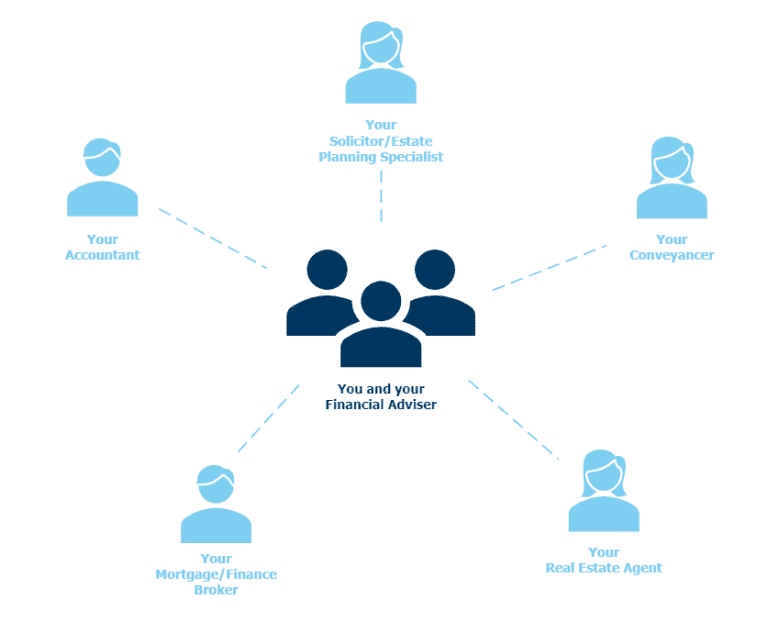

Over the coming weeks in a 6 part mini-series, I’m going to show you how you can build your A-Team of Financial Advice Professionals. We’ll introduce all of the team…

View our September 2022 Webinar below – “Market Crashes – A Risk or an Opportunity”. Where are we now? The best investment strategy over the long term Price and value…

Have you ever opened your broker app, or your portfolio tracker and seen a significant unexplainable drop in the value of your investment? Did you have one of these reactions….?…

In 2004, Michael Lewis wrote a fascinating book called Money Ball – which went on to become a major Hollywood movie starring Brad Pitt. The book tells the tale of…

I had a chat with a mate of mine this morning – a 30 y/o self-employed tradie. He works hard, he pays his mortgage, he has some investments, but during…

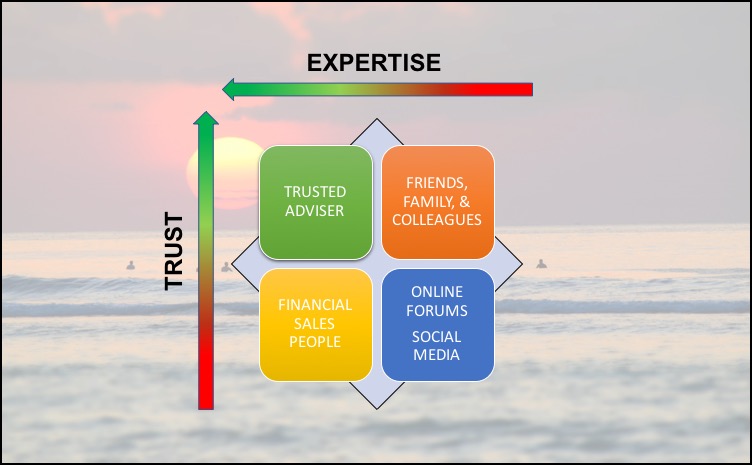

Where you get your financial advice makes an enormous difference to your outcomes. But unfortunately, many people confuse trust for expertise and don’t get the results they had hoped for (or were…

Every year around about this time people start preparing to make New Years Resolutions – 80% of which fail by the second week of February according to this FSU News article. Yet…

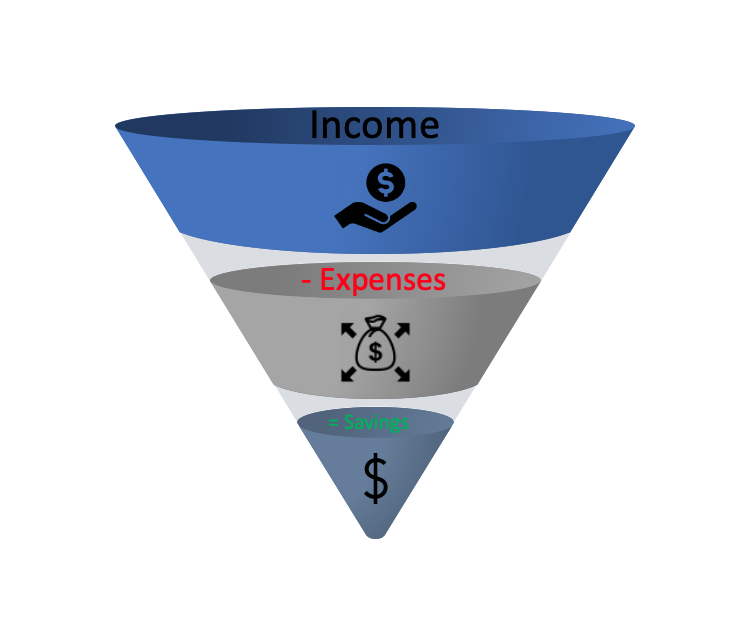

Let’s face it, when it comes to wealth creation ‘saving’ is about the most boring method I can possibly think of, but trust me on this…. saving is the bedrock…

Well, this is a little controversial… stop saving for the kids? ‘What kind of sick child hating finance author is this bloke….’ I hear you saying. Or perhaps…

The Government has announced grants of $25,000 to encourage people to build a new home or substantially renovate their existing home. The HomeBuilder scheme targets the residential construction market by…

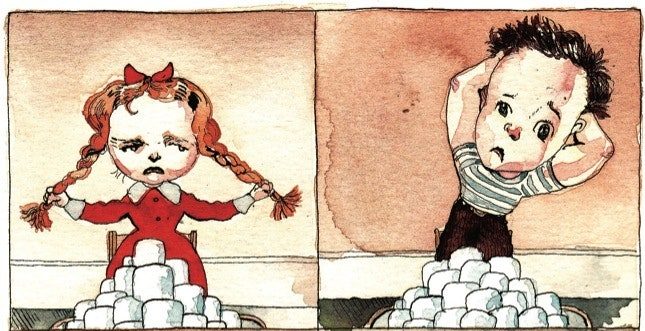

In 1972, a Stanford University psychology professor named Walter Mischel ran an incredible experiment. A child was given a small treat – in this case they could choose between…

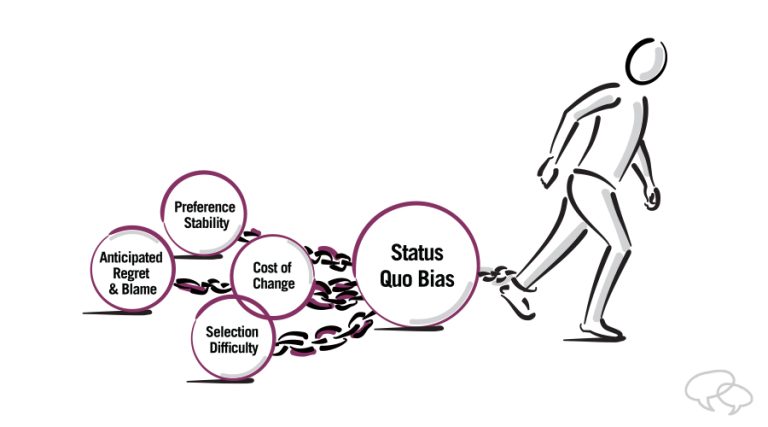

Believe it or not, being a successful <insert just about anything here> requires a far lower amount of expertise and a far greater amount of behavioural and emotional management than…

End of content

End of content