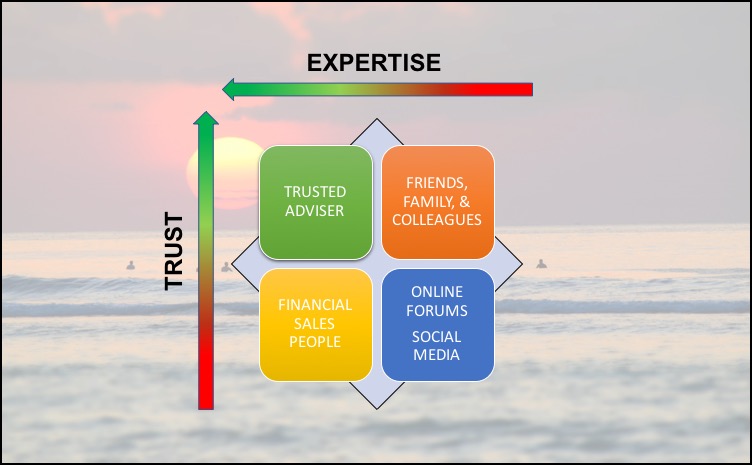

Where Are You Getting Your Advice?

Where you get your financial advice makes an enormous difference to your outcomes. But unfortunately, many people confuse trust for expertise and don’t get the results they had hoped for (or were…

Where you get your financial advice makes an enormous difference to your outcomes. But unfortunately, many people confuse trust for expertise and don’t get the results they had hoped for (or were…

Every year around about this time people start preparing to make New Years Resolutions – 80% of which fail by the second week of February according to this FSU News article. Yet…

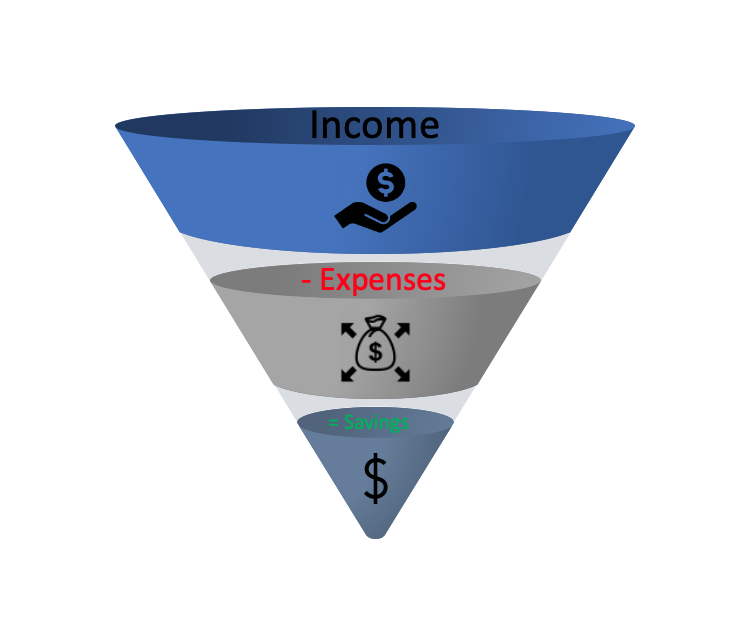

Let’s face it, when it comes to wealth creation ‘saving’ is about the most boring method I can possibly think of, but trust me on this…. saving is the bedrock…

Well, this is a little controversial… stop saving for the kids? ‘What kind of sick child hating finance author is this bloke….’ I hear you saying. Or perhaps…

The Government has announced grants of $25,000 to encourage people to build a new home or substantially renovate their existing home. The HomeBuilder scheme targets the residential construction market by…

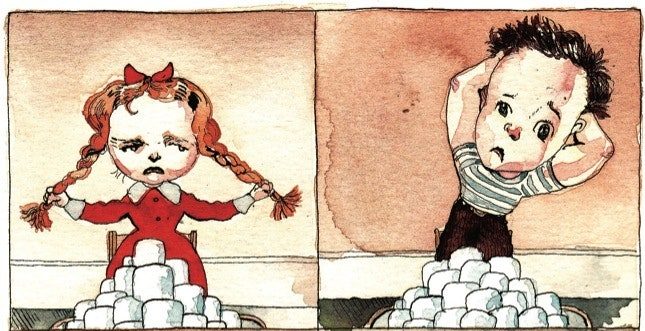

In 1972, a Stanford University psychology professor named Walter Mischel ran an incredible experiment. A child was given a small treat – in this case they could choose between…

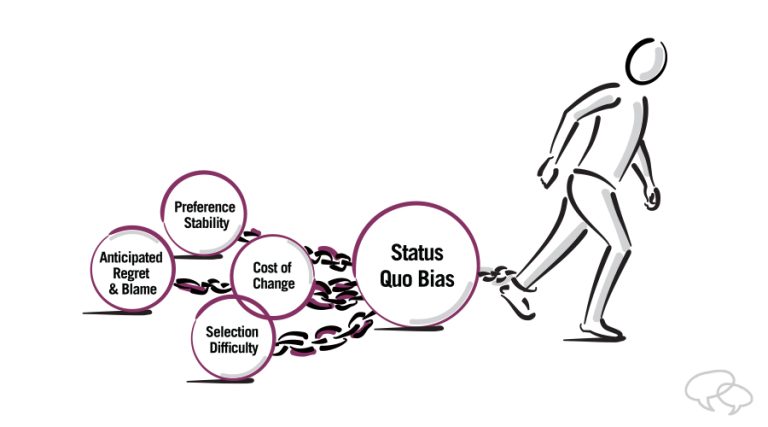

Believe it or not, being a successful <insert just about anything here> requires a far lower amount of expertise and a far greater amount of behavioural and emotional management than…

COVID-19 ACTION PLAN With Coronavirus risk mitigation measures ramping up it’s getting pretty rough out there at the moment and my heart goes out to anyone who is doing…

On Sunday 22 March 2020, the Federal Government released a $66.1 billion stimulus package, with total stimulus equating to nearly 10% of Australia’s Gross Domestic Product (GDP). The aim of…

The first quarter equity market rally continued into April in light of dovish Central Banks and improving Chinese data. Cuts to Germany’s growth forecast brought concerns around Eurozone weakness. The…

A client of mine is a forward thinker and works in senior management of large national construction company. A few weeks ago asked us to put together a financial health…

The most common statement we hear from school teachers during our first meeting. “I wish we met you 10 or 20 years ago!” It is a fantastically rewarding feeling making…

Did you know this week is Live Life Week? CHG Integrated Wealth is holding Live Life Week, to remind Australians about the importance of financial planning and living life.

I was recently away with my family for my son’s school sport. I spent 4 days out of the office and it got me thinking, “why do I do what…

Our office will be closing for the Christmas holidays from Tuesday 22nd December 2015 at 3pm (QLD) and re-opening on Wednesday 6th January 2016 at 8.30am (QLD). We wish you…

End of content

End of content

Complete the following form and we will send the Save Tax ebook to your inbox.