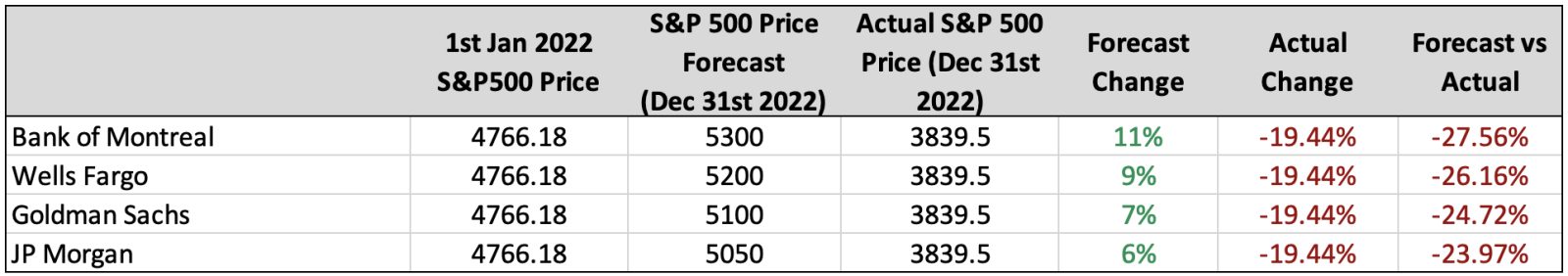

Every year around this time the world’s largest investment banks (experts, one might reasonably assume) compile their forecasts of where financial markets will end up at the end of the year. They scrutinise a mountain of economic data, analyse reserve bank meeting minutes, compile sophisticated quantitative models, and then tell the world (with the utmost confidence) where markets will finish the year. Whilst we’re yet to see the full suite of forecasts hit for 2023, a look back at 2022 is quite instructive…

What Happened in 2022?

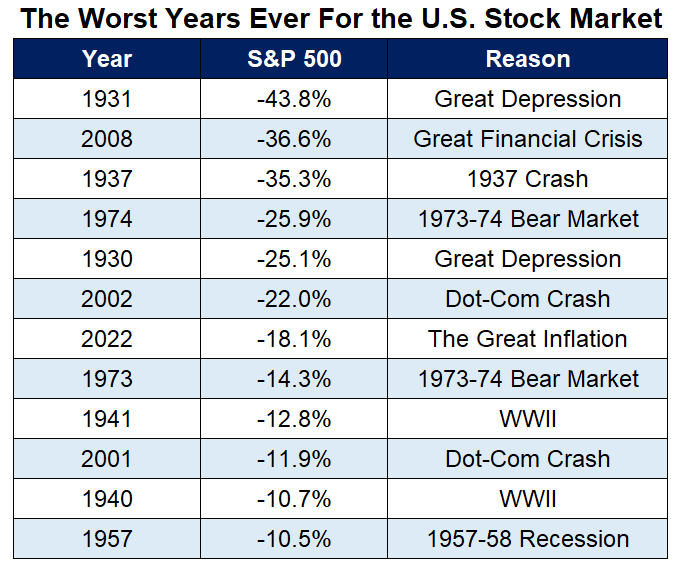

An average of the world’s foremost experts, would have seen the US Stockmarket (As measured by the S&P500 Index) rise by 8.25%. The reality however was that over the course of 2022, the US Stockmarket finished down 19.44% – its 7th worst calendar year performance in history.

Source: https://awealthofcommonsense.com/2023/01/2022-was-one-of-the-worst-years-ever-for-markets/

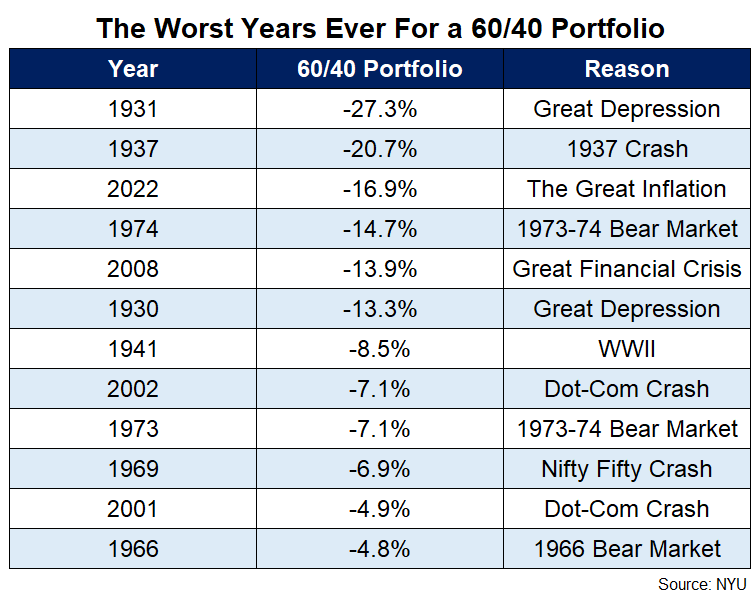

And to add insult to injury, due to the worst calendar year performance ever for US Government Bonds, a diversified portfolio comprised of 60% US Shares, and 40% US Bonds suffered its 3rd largest calendar year fall in history (Worst than the GFC in 2008!)

So, if the world’s ‘best and brightest’ economists do no better at forecasting than a blind-folded monkey throwing darts at the financial section of the Australian Financial Review, why do we put so much credence in what these so-called experts have to say?

“Fundamentally, people hate uncertainty and will try to remove it. So, precise quantified forecasts seem to provide a degree of certainty in an otherwise uncertain world,” – Shane Oliver, AMP Capital Chief Economist.

Behavioural Economists refer to this as ‘Authority Bias’ – an overwhelming desire for people to blindly follow the instruction and/or opinion of a perceived authority figure. Whilst this may intuitive sense, studies have continuously shown that “experts” (in just about any field) are often outdone by simple algorithms when it comes to their ability to forecast. In fact, algorithms beat experts in studies including predicting the outcome of cancer treatment, the success of a business venture, the likelihood of violent behaviour, divorce rates, and the winners of sports games.

A wonderful example of this common bias is Michael Lewis’ book Moneyball – which went on to become a major Hollywood movie starring Brad Pitt. The book tells the tale of Billy Bean, the manager of US Major League Baseball team the Oakland A’s and how he managed to take a team with one of the lowest budgets in the league to the play-offs – on multiple occasions!

How did he do it? Well, conventional wisdom long held that big name, highly athletic hitters and young pitchers with rocket arms were the ticket to success… but without the financial firepower to sign them, Bean had to find another way. He totally ignored the advice of the ‘expert’ talent scouts and searched the league for ‘undervalued players’ – quiet achievers who didn’t necessarily ‘hit it out of the park’, but who made bases, delivered consistent performance, and had solid statistical records. Rather than chasing a 20% chance of a home run (and a much higher probability of a strikeout), he opted for an 80% chance of taking a base. The method (known as Sabermetrics) went on to be embraced by many teams and changed the way in which many of the major league franchises do business.

So If expert opinions are about as useful as flyscreens on a submarine, what do we do about it?

My top tips:

- Ignore short-term forecasts – they are woefully incorrect most of the time.

- Your Investment strategy should be tied to your specific goals, needs, and objectives.

- Control the things you can, and ignore the things you can’t.

- Focus on the investment time frame that matters (is it a 5-year plan? a 10-year plan? a plan for retirement? or a plan for the rest of your life?)

- Long-term averages provide a much better guide than short-term forecasts. Shares and property have returned 8 – 10% p/a on average over the last 100+ years…. but this average includes single years that range between -46% and +46%.

- Diversify your investments across non-correlated assets

- Use strategies such as dollar cost averaging to help mitigate timing risk.

- Stay invested – the average investor underperforms the fund they are invested in by a HUGE margin. This is because they try to ‘time the market’ by jumping in when forecasters are cheery, and selling out when forecasters are negative. The exact opposite behaviour is likely to be far more lucrative!

- Add to your investments regularly and routinely – market timing and forecasting are a fool’s errand.

My 2023 Forecast:

Haha – Just kidding!

I have no idea what 2023 will deliver, and nor does anyone else… and besides which, it really doesn’t matter. What matters is that you have a sound long-term plan that will be successful regardless of what happens this year or the next. By working with our qualified financial advisers Lisa & Saul on a holistic financial plan, you’ll learn to stop listening to the news, the ‘expert forecasts’, and particularly the doomsayers. Instead, you’ll develop strategies to help get through the inevitable rough patches, the clarity of what you need to do to reach your destination, and the confidence that your plan is on track.

Book yourself in for a 15-minute discovery meeting to have a chat about your personal financial situation – it’s time to set yourself up for success in 2023!

If you’re fascinated by our innate cognitive biases, the weird and wonderful ways our brains deceive us, and you want to learn more you might find the following books interesting:

Thinking Fast & Slow – Daniel Kahneman