Believe it or not, being a successful <insert just about anything here> requires a far lower amount of expertise and a far greater amount of behavioural and emotional management than most people recognise (or care to admit). We see time and time again that this is particularly true of people’s finances. As humans, we make simple decisions complicated because emotions cloud our judgment – fear, greed, anxiety, uncertainty, overconfidence, spotting trends that don’t exist… they all distort what should otherwise be a simple logical choice. Let me give you an example.

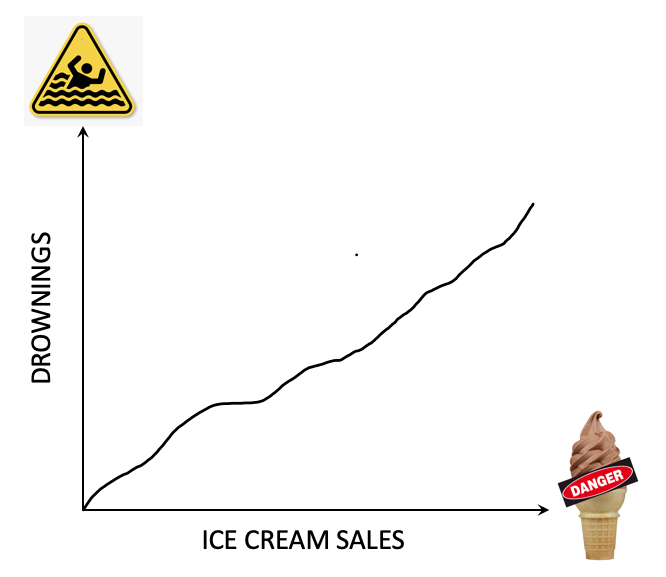

There is an enormous body of scientific data that proves that ice cream causes drownings. The graph looks something like the one above – The more ice cream sales there are on any given day the more people down. What do you think causes this phenomenon?

If you’re like most people you started reaching for answers – some of them completely far out, and some more plausible… ‘Overweight people are both more likely to buy ice cream and drown’, ‘Everyone knows you don’t go swimming until one hour after a meal’, ‘Maybe when saltwater mixes with ice cream it froths up and causes a chemical reaction…..

Hopefully, you caught yourself pretty quickly and came to the realisation that hot summer days cause both higher ice cream sales, and more swimming (and hence drowning). Ice cream sales and drownings may be correlated, but there is no causation at all. They are both caused by a third unrelated event. People make these simple errors in judgment all the time with their finances and it can cause horrible outcomes.

Welcome to the strange world of Cognitive Biases – the inbuilt human flaws that constantly drag you toward the wrong answer, and stop you reaching your true wealth potential….

- That feeling you get when you want to switch your super to cash right at the bottom of the market (Loss Aversion Bias)

- The tendency to take more risk with found or won money than earned money (The House Money Effect/Bias)

- Seeking out information that confirms an existing belief rather than considering alternative viewpoints (Confirmation Bias)

- The belief that things we own are worth more than an equivalent thing that we don’t own (The Endowment Effect)

- Extrapolating the future from past events and thinking we have superior predictive ability (Hindsight Bias)

I could fill a page with all of the weird and wonderful ways our inbuilt human flaws hold us back and damage our financial health, but the one I want to zoom in on today is one of the most common and most wealth destroying biases of them all….. doing nothing – otherwise known as Status Quo Bias.

The essence of status quo bias is that people prefer things to remain the same – even when the cost of change is low, and the reward for change is great.

Allow me to rephrase…

People will give up tens of thousands, or in many cases, hundreds of thousands of dollars in savings or investment returns because they are too comfy doing nothing, or too scared to do something!

The godfathers of behavioural economics, Daniel Khaneman, and Amos Tversky linked status quo bias to loss aversion, observing that people feel greater regret for bad outcomes that result from new actions taken, than for bad consequences that are the consequence of inaction (Kahneman and Tversky, 1982). Humans are indeed strange creatures!

The worst thing about status quo bias is that our inaction is brought about because:

a) There are no immediately identifiable consequences of doing nothing.

b) Opportunity cost isn’t always highly visible.

c) We have a fear of experiencing regret (known as buyers remorse)

d) We can easily identify the cost of change, but the (overwhelmingly larger) reward for change is more difficult to quantify.

e) There is a misconception that small changes won’t make much of a difference

Well, I have to tell you that small differences today, make a MASSIVE difference to your long term wealth, so it’s well worth the effort to take action.

Let me give you a few examples:

- Refinancing your $500,000 home loan and getting a 0.5% better interest rate saves you $54,245 over a 30-year loan term.

- Paying off an extra $200 per month (1.5 coffees a day) on the same home loan saves another $66,216 and knocks 4 years and 2 months off your loan term.

- Ensuring you’re not over-insured (Life Insurance, TPD, and Income Protection) can save you upwards of $10,000 p/a! (particularly once you’re in your 50’s and 60’s)

- Achieving a 1.0% better return in your super fund (8% as opposed to 7%) makes you $234,884 better off after 30 years! (say from age 35 to 65)

- Making $1000 p.a extra concessional contributions to the same super fund makes you a further $88,155 better off! (and that doesn’t include the tax and cashflow benefits!)

- Those $1000 p.a super contributions could be funded by savings on your utility bills and general insurances by using one of the many comparison websites available.

These small tweaks produce a combined benefit of $443,500 and we haven’t even scratched the surface!

It may not be easy to see these savings or potential returns when you’re not looking for them, but it’s my job to help you find them and unlock the hidden opportunities that could make a major difference to your life.

COVID-19 SILVER LININGS:

Sometimes change isn’t a considered choice – sometimes it is thrust upon us and we have no choice but to adapt. Whilst the short-term impacts of COVID-19 are creating some serious challenges for many people, some clients are discovering some silver linings… ‘essential expenses’ that aren’t so essential after all, recognition of frivolous spending, and financial resources being allocated to things that don’t help them reach their financial goals.

Have a good think about the expenses you choose to re-introduce back into your life post COVID-19…. Perhaps there are some better options for that free cash flow.

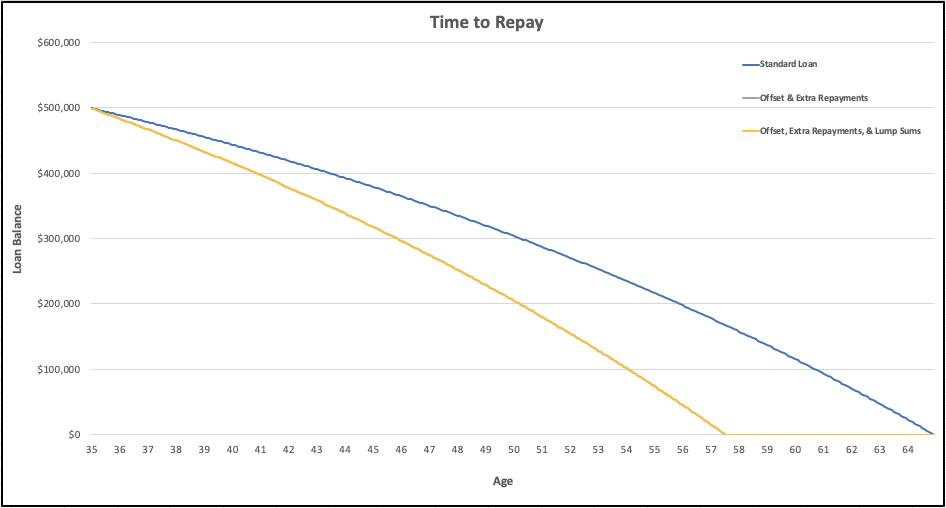

DEBT REDUCTION:

Did you know that an extra $100.00 p/w applied to a $500,000 loan @ 2.99% interest saves $69,528 and reduces the loan term to 22.75 years from 30?

Not quite interesting enough? OK, well how about investment?

INVESTMENT:

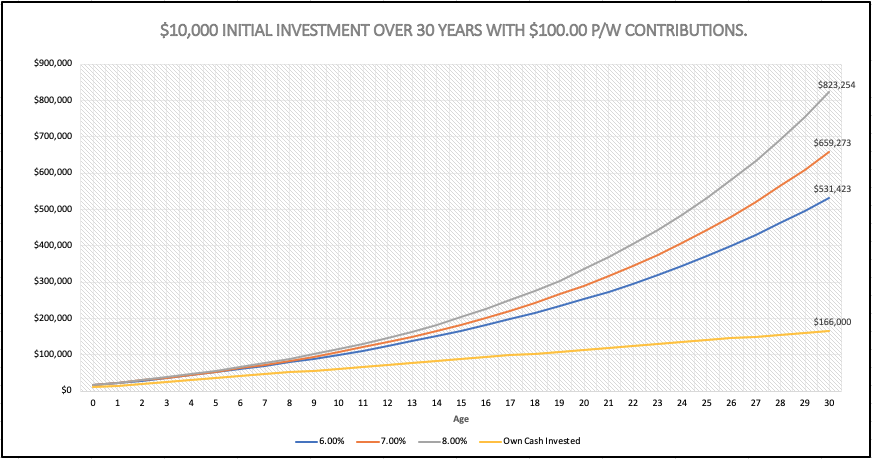

The graph below shows the returns of an initial $10,000 investment + $100.00 p/w regular contributions over 30 years, earning 6%, 7%, or 8%.

On the 8% Returns assumption, your wealth grows to $823,254 over 30 years. And the best bit…. it only cost you $166,000 of your hard-earned dollars.

*Does not consider the impact of taxation.

YOU DON’T HAVE TO CHOOSE ONE OR THE OTHER:

Many people don’t know that you can have your cake and eat it too – it’s totally possible to aggressively pay off your mortgage and invest at the same time. You can also have huge wins across all of the other areas I haven’t mentioned – boosting your super balance, picking up tax benefits, enhancing your cash flow, and protecting your family. With the right plan, you can truly have Clarity, Success, and Financial Freedom.

Doing nothing is literally costing you a fortune, so it’s time to get motivated and time to take some action. Get in touch today to have a chat about your personal situation, and see if we can uncover some of the massive opportunities being hidden behind your status quo bias. It will be a small investment in time for present-day you, and a MASSIVE reward for future you.

Stay safe all.

Saul.