Well, this is a little controversial… stop saving for the kids? ‘What kind of sick child hating finance author is this bloke….’ I hear you saying.

Or perhaps you’re fondly reminiscing about your first ‘Dollarmite’ account, and how the process of packaging up your spare change and banking it once a week instilled in you an appreciation for saving?

Well, as a child of the 80’s, a recent father, and the former owner of a Dollarmite Account I can tell you that there are a few MASSIVE differences between then and now – and that what worked in the late 80’s and early 90’s doesn’t work now.

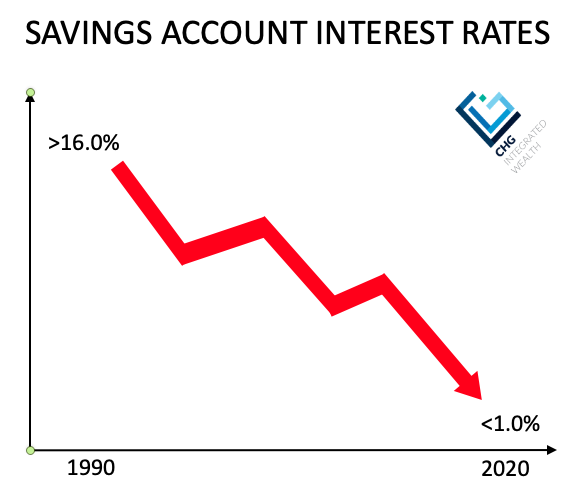

Exhibit A:

Shockingly, despite the precipitous fall in interest rates (and hence savings accounts rates) over the last 30 years, the big 4 bank’s advertising campaigns have transcended the economic reality and have managed to convince people that ‘Youth Saver’ accounts are a good idea… they’re not.

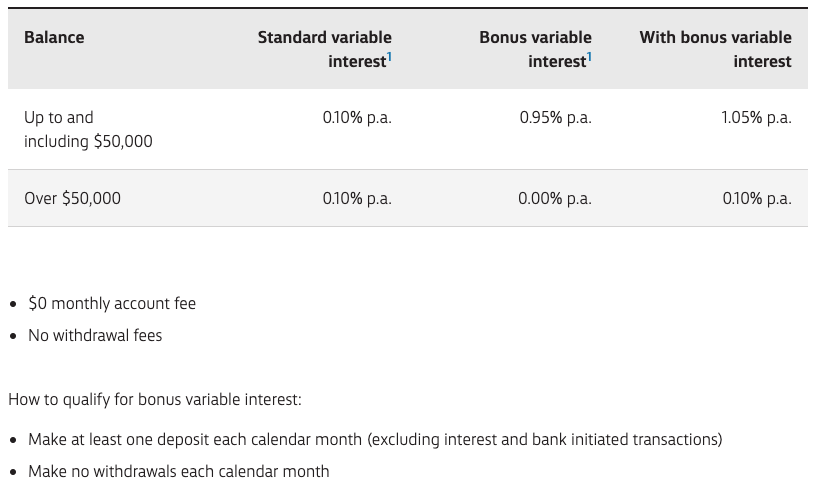

Exhibit B:

Commonwealth Bank Youth Saver Interest Rates as at Sept 2020

As a recent example of how well these advertising campaigns have worked, my mother-in-law recently gave our 14-week old daughter a gift to start her first bank account. I didn’t have the heart to tell her that it’s not going into a bank account. It will indeed help give Emily a head start for the future, but given that she won’t be getting her grubby little hands on the $ till she’s an 18-year old she has a long enough investment timeframe for something a little more adventurous than a saving account… yes, Em will become an investor, not a saver and the difference over the next 18 years will amount to many thousands of dollars (that she probably won’t thank us for… but I guess that’s just part of the joy of being a parent).

You see, there are 5 key ingredients to Wealth Creation.

- Time

- Capital

- Cashflow

- Risk

- Behaviour

Whilst you may not have all of the key ingredients, taking advantage of the ones you do have can make an incredible difference, and when it comes to children’s savings the one thing you have on your side is time. There is an inverse relationship between time and cashflow (regular savings/contribution amount), meaning….

THE MORE TIME YOU HAVE, THE LESS CASH YOU NEED TO CONTRIBUTE,

SO LET TIME DO THE HEAVY LIFTING!

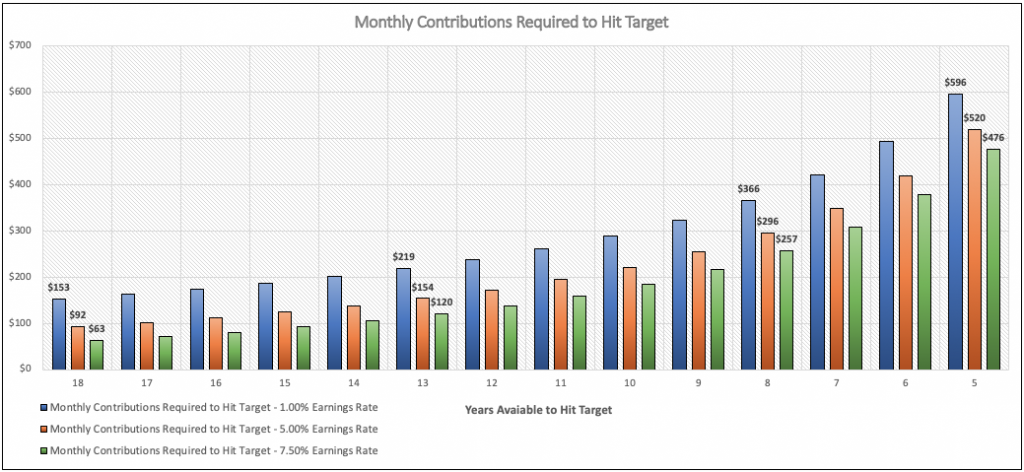

*Does not consider the impact of taxation

The chart above shows the amount of monthly contributions required to turn an initial amount of $3,000 into $40,000 within 18 years – depending on when you get kick-started.

The blue bars represent an earning rate of 1.00%. What it shows is that to hit your $40K target, you would need to chip in $153.00 p/m if you got kick-started on your child’s day of birth. If however, you waited until their 5th birthday to start you’d need to chip in $219.00 p/m, and if you waited till their 13th birthday (5 years to go), you’d need to contribute $596.00 p/m….3.89 times more than the monthly contribution required if you started on their day of birth.

The green bars show the monthly contribution amount required on an earnings rate of 7.5%. What it shows is that to hit your $40K target, you would only need to chip in $63.00 p/m if you got kick-started on your child’s day of birth. If you waited until their 5th birthday to start saving for them, you’d need to chip in $120.00 p/m, and if you waited till their 13th birthday (5 years to go), you’d need to contribute $476.00 p/m….a whopping 7.55 times more than the monthly contribution required if you started on their day of birth.

TO EXPRESS IT IN A SLIGHTLY DIFFERENT WAY, USING THE SAVINGS EXAMPLE (1.0% RETURNS) IT WOULD COST YOU $33,083 OF YOUR HARD EARNED AFTER TAX DOLLARS TO CREATE $40,000 OVER 18 YEARS. USING THE INVESTING EXAMPLE (7.50% RETURNS) IT WOULD ONLY COST YOU $13,597.

EVEN USING THE INVESTING EXAMPLE (7.50% RETURNS), GETTING STARTED ON YOUR CHILDS DAY OF BIRTH COTS YOU $13,597, BUT WAITING TILL THEIR 13TH BIRTHDAY TO GET STARTED COSTS YOU $28,582.

So stop saving for the kids… It’s costing you a fortune! You have 5 wealth creation ingredients, so Make an appointment today to explore which ones are in your pantry, and how we can use them to help you reach your goals.