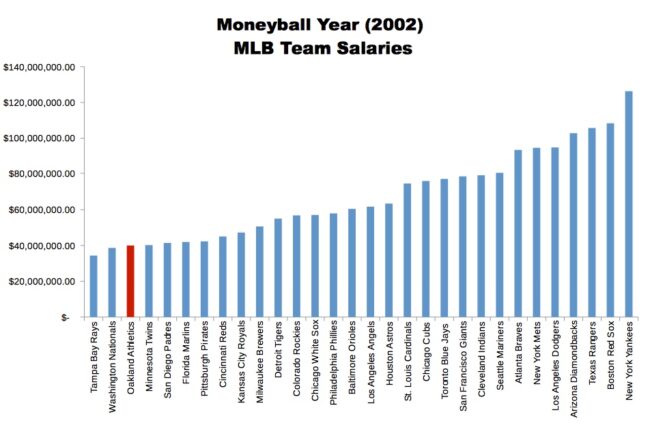

In 2004, Michael Lewis wrote a fascinating book called Money Ball – which went on to become a major Hollywood movie starring Brad Pitt. The book tells the tale of Billy Bean, the manager of US Major League Baseball team the Oakland A’s and how he managed to take a team with one of the lowest budgets in the league to the play-offs – on multiple occasions!

How did he do it? Well, conventional wisdom long held that big name, highly athletic hitters and young pitchers with rocket arms were the ticket to success… but without the financial firepower to sign them, Bean had to find another way. He searched the league for ‘undervalued players’ – quiet achievers who didn’t necessarily ‘hit it out of the park’, but who made bases, delivered consistent performance, and had solid statistical records. Rather than chasing a 20% chance of a home run (and a much higher probability of a strike out), he opted for an 80% chance of taking a base. The method (known as Sabermetrics) went on to be embraced by many teams and changed the way in which many of the major league franchises do business.

So what has this got to do with investing? Well, you should probably ask yourself – Am I trying to hit it out of the park (and is this approach paying off), or have I opted for the approach with the lower reward, but the statistically greater chance of success?

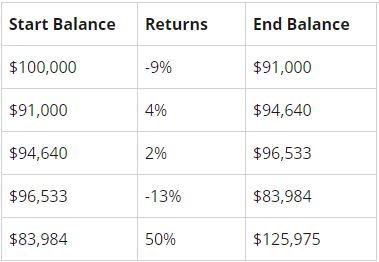

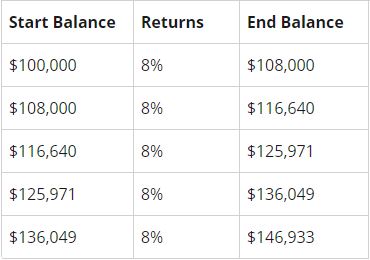

Is achieving 8% p.a on average each and every year better or worse than having a few backwards years, a few flat years, and then a 50% rainmaker year? Lets find out…

Trying to Hit it Out of the Park

Opting for the statistically safer option

In our lives we bump into this lesson in many forms – The Tortoise and the Hare, Rome wasn’t built in a day, Slow and Steady Wins the Race. The ultimate takeaway being that perseverance, consistency, and time are the keys to success. In finance we frame it up in a different way -“Get Rich Slowly”.

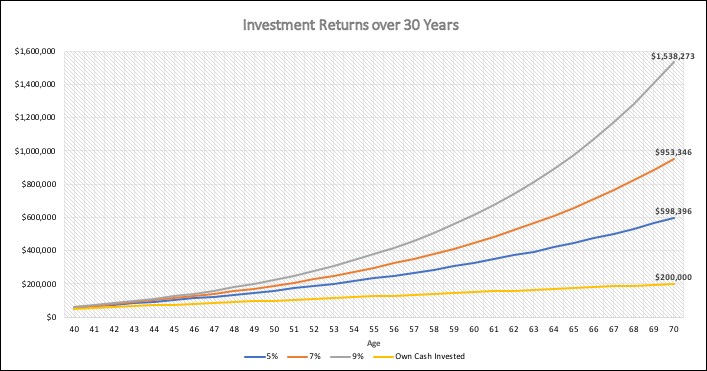

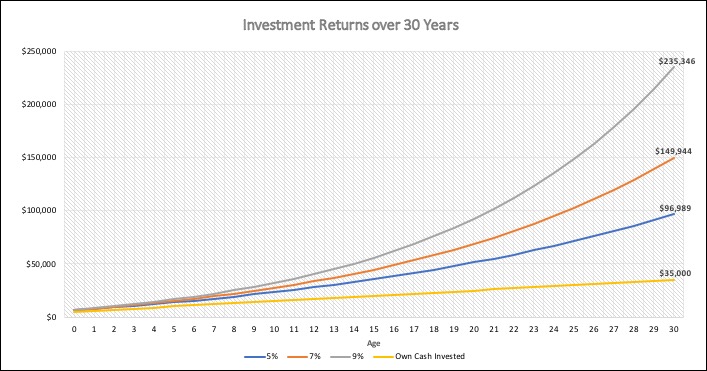

If you’ve never really stopped to appreciate the power of compounding investment returns, then its time you did… and here’s why.

What you’re looking at is the growth of an initial $50,000 investment, with additional annual contributions of $5,000 achieving either 5%, 7%, or 9% returns over 30 years…. and here is the best part – the cost to you is the yellow line. That’s right, parting with $200,000 of your ‘hard earned’ over 30 years, grows your wealth to $1,538,273 if you achieve 9% investment returns. Not bad huh?

‘But I don’t have $50,000 to invest’ I hear you say – well that’s OK, you’ll be shocked at how time and consistency does amazing things to even a small initial investment – and I’ve made an excel calculator for you that you can tweak for your own unique circumstances! Just get in touch and ask for a copy and I’ll send it through.

I constantly see people who stress about future expenses – but fail to put plans in place to make them achievable.

- How will I pay for my daughters wedding?

- How can I afford to retire?

- How do I pay for my children’s education or help them with a house deposit?

- How do I make the income I need without have to trade my precious time for money?

Here’s my approach…

I won’t be paying for my kids education. I won’t be paying huge chunks of cash for my daughters wedding, and I won’t be giving them a house deposit. I will give them each $5,000 when they’re born, and $1,000 per year every year thereafter and they can use the fund to pay for their own expenses. Here is what that looks like.

On the 9% return assumption, my 19 y/o will have ~$84K with which to fund his or her tertiary education (and it will have cost me $24K). If they use HECS, and manage to work a bit to support themselves so they can leave their funds to grow, they’ll have $149,000 as a 25 y/o with which to use for a house deposit and / or a wedding (and it will have cost me $30K). And if they manage not to touch their fund at all, as a 30 y/o they’ll have $235K (which will have cost me a grand total of $35,000 over 30 years) – at which point I’ll turn off the tap!

So stop taking excessive risk chasing multi-baggers, stop trying to hit it out of the park, get comfortable with earning 7-10% over the long term (depending on your risk profile) and let time do its thing. If picking stocks, isn’t rewarding you for the amount of risk you’re taking, a diversified portfolio of managed funds with exposure to multiple asset classes, multiple markets, multiple countries, multiple industries, and multiple fund manager styles may be just the ticket.

An ex manager / mentor of mine used to say “A little a lot, rather than a lot a little” – his variation of the old idiom, and whilst he was probably referring to cleaning the office or keeping in touch with clients its pretty astute advice for investors too.

Don’t forget to get in touch for your free copy of the investment returns calculator – Find out what your potential earnings power is over various time periods….and then put a plan into action!